In developing economies, small and medium-sized enterprises can contribute up to 60 percent of total employment opportunities and up to 40 percent of national income. Yet, many commercial banks consider the risk of lending to small and medium-sized enterprises too high. Business owners can find themselves locked out of access to credit if they are too big to qualify for loans from microfinance institutions and too small for commercial banks.

Since 2008, Global Communities has been a leading provider of loan guarantees, in partnership with the U.S. Development Finance Corporation (formerly OPIC), the U.S. Agency for International Development and the U.S. Department of Agriculture, working to unlock access to credit for these innovative and essential businesses.

Our facilities partially guarantee the loans of commercial bank partners to reduce the risk and increase their willingness to lend to companies with growth potential and big futures ahead. Investing in small and medium-sized businesses through Loan Guarantee Facilities helps to diversify and strengthen developing economies and provides incentives to commercial banks to begin lending in new and emerging markets.

Financing Clean Technology

Small and medium-sized enterprises are critical providers and users of the clean energy technology needed to mitigate the impact of climate change. Global Communities’ Loan Guarantee Facilities have supported investments in solar energy solutions, including for a company delivering solar lighting to displaced Syrians, and provided technical assistance to banks as they strengthen lending practices and develop credit products to support clean technology solutions.

Advancing Agribusiness

The Agribusiness Investment for Market Stimulation (AIMS) project worked to increase agricultural trade through improving access to markets and financing in Kenya, Tanzania and Malawi. The core of the AIMS program was a $50 million Loan Guarantee Facility backed by the U.S. Development Finance Corporation and supported by the U.S. Department of Agriculture. Global Communities delivered technical support to targeted banks and small and medium-sized agribusinesses, including cooperative enterprises, agricultural farmer associations and savings and credit cooperative societies, to enhance their bankability and facilitate market linkages and access to market information.

Our Approach

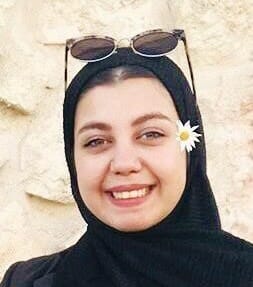

Global Communities believes in the transformative power of small businesses and has facilitated loans for companies focused on auto services, construction, consumer finance, fashion retailing, food processing, hospitality, information technology and more. Our Loan Guarantee Facilities focus on providing training and support to female entrepreneurs, who can face additional barriers to accessing credit. Programs such as the Women in Business Capacity Building Training Initiative, based in Egypt, deliver financial and banking workshops for thousands of current and aspiring female business owners.

$389 m

total in loan guarantees

23 %

amount of businesses in portfolio owned by women

282,000

jobs created in Iraq alone

Our work in this area reaches

Resources

Briefs & Case Studies

Resilience, Rebuilding and Humanitarian Assistance: Lebanon Focus

Global Communities has implemented community-driven humanitarian assistance programs for decades, responding to the needs of millions of families in countries around the globe. From natural disasters, to armed conflict, to social and economic upheaval, we are there to meet the humanitarian needs of vulnerable people affected by crisis. We work in partnership with a range…

Research & Publications

Covid-19 Impact on Performance of Micro and Small Businesses in Egypt

CHF Management and Consulting Services Egypt S.A.E. (CHF MCSE) provides loan guarantees to small- and medium-enterprises (SMEs) in Egypt and produced a new report called Covid-19 Impact on Performance of Micro and Small Businesses in Egypt. In light of the Covid-19 situation across the country of Egypt, SMEs are up against exceptional challenges whose effects…

Briefs & Case Studies

Promoting a Fee-for-Service Business Advisory Services (BAS) Market for Agribusiness SMEs in East Africa

The Agribusiness Investment for Market Stimulation (AIMS) program was a seven-year USD 19 million program funded by the United States Department of Agriculture (USDA), which included a USD 50 million Loan Guarantee Facility (LGF) backed by the Overseas Private investment Corporation (OPIC). AIMS utilized a market systems approach to support agribusiness small and medium enterprises…

Research & Publications

February 2020 Updates – CHF Management and Consulting Services Egypt S.A.E.

CHF Management and Consulting Services Egypt S.A.E. (CHF MCSE) provides loan guarantees to small- and medium-enterprises (SMEs) in Egypt. With funding from Overseas Private Investment Corporation (OPIC), Global Communities through CHF MCSE has established a $250 million loan guaranty facility to support lending to the enterprise sector in Egypt with a strong focus on the…

Research & Publications

January 2020 Updates – CHF Management and Consulting Services Egypt S.A.E.

CHF Management and Consulting Services Egypt S.A.E. (CHF MCSE) provides loan guarantees to small- and medium-enterprises (SMEs) in Egypt. With funding from Overseas Private Investment Corporation (OPIC), Global Communities through CHF MCSE has established a $250 million loan guaranty facility to support lending to the enterprise sector in Egypt with a strong focus on the…

Research & Publications

November 2019 Newsletter – CHF Management and Consulting Services Egypt S.A.E.

CHF Management and Consulting Services Egypt S.A.E. (CHF MCSE) provides loan guarantees to SME loans in Egypt. With funding from Overseas Private Investment Corporation (OPIC), Global Communities through CHF MCSE has established a $250 million loan guaranty facility to support lending to the enterprise sector in Egypt with a strong focus on the small- and…